|

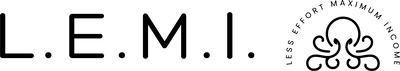

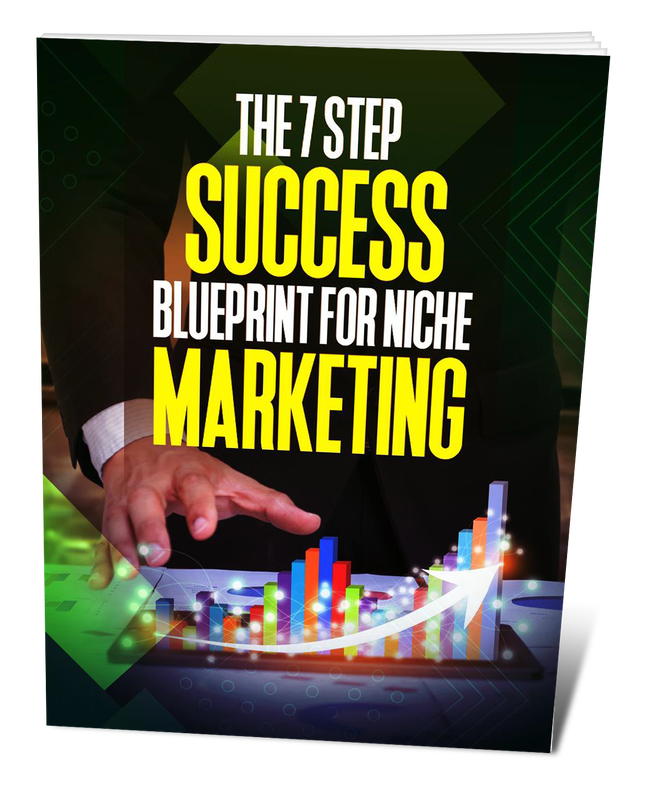

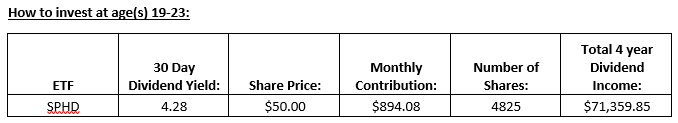

WHAT IS THE REAL GOAL OF "LIFE"?12/18/2021 0 Comments As we know, this topic can be debatable on all levels. This is our own opinion so please, enjoy the post. Observing today’s society, technology is allowing for the youth to grow up faster than they need to. When talking to a teenager about life, they broke down to me as they indicated they were scared of the future. I asked what their plan was after high school, but they said the common answer of college and get a job. That is when I asked, “What do you think the end goal is life? What is the whole purpose of life?” It seemed to catch them off guard as they didn’t really understand the question so I asked it again but a bit more detail. “Most say that being happy and helping others is the purpose of life, but what do you think it is? What do YOU think you should do? What is the end GOAL you are reaching for?” They then answered, “To get a job and start a family and be happy.” Which is a common answer to those who are naive to life. Let’s think about it. Look at your family, how many of your family members go to work and live pay check to pay check trying to stay afloat in this game called “life”? Do they seem to be truly happy living like that? Do you think they would rather be able to wake up and do as they please - when they please – as they please not worrying about how they will pay their bills, feed their family or get evicted? Yes. Trust me the answer is, “Yes”…. The question is, how we get there. We see the goal of life is to be free with financial freedom. The earlier you start the faster you may get there. That is why it is important for us to address this with the younger generation. What is financial freedom though? The short answer, it is to have enough money saved, invested and incoming that you do not have to work. There are many ways to establish financial freedom, but you must start a young age. If you feel that they path you want is to graduate high school, go to college, get a great job and then invest, that is great. Go for it! If we were to do it all over again, this is what we would do: Age 9 – 14 Ask my guardians to open up a custodian account with and investment firm to purchase stocks (ETFS or Bonds). Invest into this account through birthday money, washing cars, cutting grass, do chores. Anyway I could make a few dollars… I would do and through it into some ETFs. Starting monthly Income for age(s) 9-14: $0 Previous Balance for age(s) 9-14: $0 If we start investing into an ETF with a 4.28 dividend yield, we could make an additional $10,000 in five years. Of course, we know that these numbers would fluctuate, but this is just to give you an idea of your money working for you to get you closer to your financial freedom. Ending Balance for age(s) 9-14: $39,900.00 Age 15-18 While going to school, I would keep accumulating ETFS in my custodian account by getting a part time job, birthday money, graduation money and finding ways to make extra money to invest into ETFs. Starting Income for age(s) 15-18: $494 + $400 = $894/month $494 (Birthdays, Washing Cars, Cutting lawns) + $400 (working part time job) Previous Balance for age(s) 15-18: $39,900.00 If we keep investing into an ETF with a 4.28 dividend yield, we could make an additional $20,000 in three years. Once again, we know that these numbers would fluctuate, but this is just to give you an idea of your money working for you to get you closer to your financial freedom. Now. You are 18 years old with $94,000 dollars in the market working for us! We also have 2,123 shares that we can sell covered calls in the market with making an additional income. That can bring in an additional $400 a month, but we didn’t include that into the numbers - not yet at least. Ending Balance for age(s) 15-18: $39,900.00 + $54,200.00 = $94,100.00!!! Age 19-23 Starting Income for age(s) 19-23: $1,225.00/month Previous Balance for age(s) 18-23: $94,100.00 After graduation, we would then go into the military. Finding an MOS. (military occupation Specialty = a job) that is offering a signing bonus and job that can help us after we get out of our military contract. New recruits can earn up to $40,000 in enlistment bonuses! Realistically you will be looking at around $15-$20,000. Once we go through all of your military training (Boot camp, MOS training etc…) and arrive at our first duty station, we would get a second job!!! Yes, that is correct you will be working in the military during the day and a second job after that. Now you will be 19 with two lines of incomes as your previous invested ETFs are building dividends. Let’s take a deeper look into this: We signed up for the military and got a $20,000 signing bonus. We would get $10,000 now and the remaining $10,000 at the middle of our contract. We also took away the taxes for from the bonus so after all that we would purchase $7,000 worth of ETFs shares. We also increased the share price just for this example. WOW… now we are 23 years old and have around $200,000 and 4,825 shares working for us in the market. Of course there are other variables we did not really dig into, but once again this is just so you get an idea. Like your pay increases as you are in the military, your part time job while you are in the military. There are so many benefits that come with joining the military:

The most important factors we suggest are…

“You have probably heard the expression “the first million is the hardest to earn.” That statement is absolutely true. The first million dollars you earn is by far the hardest million dollars to make. Most people believe earning their first million is the hardest because they start with nothing, while subsequent millions build on the previous.”

0 Comments

Its working - I GOT ALL THIS MONEY BUT WHERE DO I PUT IT?! Isn't this a great problem to have? You are getting money from cutting grass and washing cars, while people are working for you and bringing you recyclable items! Let's say the following information is for a month of work: You wash 10 cars at $5 each = $50 You cut/clean 5 yards at $10 = $50 You get $25/week for recyclables = $100 Total income revenue: $200! Now we apply the 10/20/70 rule to separate the money. $200 x .70 = $140 (Investing) $200 x .20 = $40 (Emergency Fund) $200 x .10 = $20 (Spending Fund) You now have $140 to reinvest into your business! First, remove 20% out of the $140 (140 x .20 = $28), as that will be used in the future, so set it aside for now. I suggest you purchase a small safe box for your business "petty cash" and keep it at your home. This is where you will place the $28. Put the $28 in an envelope labeled "Stock Market Funds" and locked it up. You now need to open up a bank account! Ask your guardian, parent or mentor to help you do this as you will need their signature. Once you set up your bank account, and have your debit card, deposit the remaining $112 into your bank account for future business purchases that require a debit card. You will also need a bank account for future steps like, establishing credit and stock market transfers. Your $40 emergency fund will also be placed in an envelope labeled "Emergency Fund" and placed in your small safe box. Remember, these funds are not for impulse buys or junk. These funds are for items you might need for school, the business or help the family in case of an emergency. Also, you will be driving soon, so you need to save up for your vehicle - RIGHT?! Your $20 spending money! It might seem too little but remember, this will help you learn how to "live within your means". If you only have $20, then you shall only spend $20. Trust me... as time goes on, this spending fun will increase! Now repeat this for another three months and we will come back to where you are then and I'll show you how to start investing in the stock market and establishing your credit! P.S. - Someone asked me how they could keep track of the recyclables they buy from other people, so I posted a receipt book I would use.

Are you having trouble thinking of ways to increase that $1 income?

Try this If you are recycling cans, bottles and/or vehicle batteries, we just need to increase your product. I would call my local recycling center and ask them their prices for the day (do this daily), then once you have that, you can tell your friends, family and neighbors that you will buy THEIR recyclables from them.

Sometimes in life, we just need to think outside the box a bit. Below you will see items I recommend for you to use. Enjoy and we shall see how this increases your income! Even if you can't drive to go get the suggested supplies, I have placed them below so Amazon can deliver them to you! Hello my young (and other) investors!! Today is a good day, and hopefully you all have had some thought and came up with a way to earn or obtain one dollar a day! If so, be proud of yourselves and if not, no worries as it will come to you soon enough. Understand that things take time and may come easier for one individual and harder for another, but as long as you are persistent and willing to work it will all workout. Remember to never compare your success and/or defeats to others as we all have our own “story to write”.

Being mentally ready to build a wealthy future is key, just as much as the funds you work hard for. Which brings us to another key understanding that you need. “Live within your means”, and that basically means if you make $10 and have $10, you can only spend $10. Most people tend to get into a hole called debt by not applying this concept. Will it be hard? Yes Can it be done and still be wealthy, HECK YES! Now, let’s assume we have money coming it at $1 (whatever your amount may be) a day. That is a monthly income of $30. Perfect! We now need to apply two steps:

10 / 20 / 70 - This will be our starting point to breakdown your funds. Ten percent (10%) will be your spending fund. Twenty percent (20%) will be considered your emergency fund and the remaining seventy percent will be considered your investing fund. Depending on your situation and position, these rates can differ but we need to start somewhere. Say you were trying to save for something, you can pull some from your investing seventy percent and however, we do not want to go no lower than 40%. $30 with the 10 / 20 / 70 split 30 x .10 = 3.00 (Spending Fund) 30 x .20 = 6.00 (Emergency Fund) 30 x .70 = 21.00 (Investing Fund) *** Remember, you can change these percentages around but, don’t drop your investing below 40% and LIVE WITHIN YOUR MEANS! Most 13-17 year old teenagers do not need a lot of daily money. Spending fund – This fund is for your daily spending. Some snacks, movies or what not. However, don’t forget to “live within your means”. Emergency Fund – This fund will be in case of an emergency. Although we are starting at a young age, there still can be some sort of emergencies that you can experience. Investing Fund – These are the funds we will end up putting into the stock market!! That is right, you heard me right. There are ways we for teenagers to invest within the market, so stay with us! Our next goal - Now that we have a way to make one dollar a day and know how to split it up for proper spending and saving, we need to worker a little harder. Let’s bump our daily one dollar income to three dollars!! Do not be afraid, you can do it. Self-doubt is the only doubt you need to be concerned with. Others may doubt you and what not, but anything is possible when YOU believe in yourself! Heck, I believe in you and am even here for you! Sorry for the long delay, but here is our next step into starting your future wealth, and mentors don't worry, we are working on a step-by-step guide for you to help your kids as well.

Your next goal is to find a way to make one dollar a day. This will allow for you to start thinking outside of the box and find ways to earn your first income! It may be scary at first, but remember,"Nothing worth having comes easy". Don't be so hard on yourself either, remember we have the internet and environment around us, we just need to think outside of the box. At a younger age, it is questionable as one can not work, drive or even leave the house (depending on when you are reading this, if during COVID-19) but there are ways. As I listed before here are ways that I was able to earn money: - Money as a gift from a birthday, holiday or accomplishment - "Tooth Fairy" - (But please don't just start pulling out your teeth!) - Mowing yards in the neighborhood - Washing cars in the neighborhood - Selling old items that I had and no longer used - Recycling (cans, bottles and old car batteries) Other ways some may be able to earn money: - An Allowance from completing chores at home (Mentor pays you) - Getting good grades at school (Mentor pays you depending on the grades you get) - Reading books (Mentor pays you $5 - $20 per book you read) - Taking online classes (Mentor pays you $5 - $20 per passing online class) Now that we have a direction and idea, it is up to you to apply it and move forward. This is your future and your future family's wealth your are creating. Never be embarrassed to work hard to succeed, but understand that there are ways to have an income while applying LESS EFFORT for a MAXIMUM INCOME. As for now, some must sacrifice now to get there, and we will get there with dedication. perseverance and a plan. Keep your heads up young investors, this journey will be tough at times, but that is what makes it so much better at the top! This post will talk about identifying which individual you are. You can either be the investor or entrepreneur but do not worry, there is not a right or wrong answer and a chance you can be both. Before we jump in, we must first understand that no human being is the same. We all have different situations and some maybe better or worse than others. So never compare your progression to someone else’s success, focus on you and your path.

Now, let us define both identities first. An investor is a person who commits money (aka Capital) with the expectation of receiving financial returns. Investing relies in different types of investments like stocks, commodities, and a retirement plan. An entrepreneur is a person who CREATES a business, bearing most of the risks and enjoying most of the rewards. In all, you do not even need to create a new product or service, but just with a small change and marketing, you can start a business. The reason you are identifying which identity you are now, allows for you to pick a direction that best fits you and your personality. If you are in a situation that does not allow for you to go out and start working hard labor, or being an entrepreneur then investing can be best for you. However, if you are one who is great with your hands and mind then you can start a business, and still invest. Investor – Let’s say you are in a situation to be an “investor”, but you are 15 and not sure what you can do. You can start reading! Of course, there are books that I recommended, but you also have the internet to explore. At your age, you have time on your side, so Exchange Traded Funds (ETFs) and mutual funds will be your best play. We will get more into what types investments you can do, but as of now we want to identify which persona fits you best. Because while you are reading you still need to make some money and we will talk about that later. Entrepreneur - The entrepreneur, this is the identity that will take more time and energy to perform. When I was 9-11 I started earning money by cutting yards during the winter and washing cars in the summer. That was back in the early 90s so times have changed as the internet is now your best business partner. My point is, I used what I had around me to earn money, and this goes back to our individual situations. Of course, when I was that age and making money, instead of investing it, I just bought candy and junk and that’s why we developed this website in honor of “little 90s Ray”. You will have to look around your environment and see where you can get the people around you to give you a dollar. That can be collecting cans, washing cars / dogs, walking dogs etc. Now we have identified which persona you are, its time to start making some money to invest, either your business or investments. Homework:

Remember, you can do this! You are already taking the right steps. Be patient and in time you will start seeing some money come in. https://www.investopedia.com/articles/younginvestors/09/college_finance.asp We are glad you are here. With being here you understand the importance of financial freedom. With that being said, you have already made a step that is years ahead of many 25 year old’s who want to retire at 65 saving at 10-17% percent. Image starting to invest at 15, with compound interest on your side?! We will see who is laughing later.

"Imagine that ten-year reunion and you show up in a Bentley!" Now, let’s grow that seed in your head. First, it is particularly important that you are mentally ready for this. If it were easy, everyone your age would be doing it! Like everything else, ensuring you are mentally ready for this is comparing it to a building’s foundation. With a weak "foundation", your empire will fall in the means of distress.

It will take time - The good thing about time, is that it is on your side. Starting at 15 is the time you will build your foundation buy reading first. Understanding the meaning,” Make your money work for you”. I have several books you can start off with. This will give you a starting point and direction. From there you can find things that interest you to dig deeper. It will not be easy in the beginning – Temptation is the devil. Seeing your peers having fun and spending money on unnecessary (being materialistic) items will be tempting for you to do the same, but why do it now? Honestly you will lose contact with majority of them over the years and have nothing to show from it, however, if you save and invest you will have everything to show for it in the future. Imagine that ten-year reunion and you show up in a Bentley! Sacrifice now to relax later - Sleeping in will not help you establish a foundation. We all make sacrifices; you need to decide if you want to sacrifice now at 15 or 40 working two jobs. Look around you right now. People you know are probably looking miserable and not enjoying life. Enforce the fact that you are on the right track. Make realistic goals – Short- and long-term goals are the next step. These will not only add to your plan but allow you to see your accomplishments. The viewing of your accomplishments will motivate you every time. Seeing that it is possible is an exciting feeling you will chase! Trust me, you can do it. Do not compare yourself to others – Never compare yourself to someone else’s state of progression. You do not know what they have done to get where they are. Focus on your plan and no one else’s. Factors affect people not only emotionally but timely differently. You could be facing barriers they never seen, so once you pull through them, that makes you stronger. In all, you just need to take away the following:

We got this; you will be getting the results you are expecting in no time. Just stay on track and never forget you are powerful, strong, and amazing! DO NOT STOP! |

|